China’s games industry shrinks for the first time in years

Over the past decade, China’s games industry has seen explosive growth, overtaken the U.S. in market size and given rise to global publishing giants like Tencent and NetEase. The boom is in part driven by a population that was quickly coming online and gaining purchasing power. But the heyday has come to an end as the market nears saturation and consumers tighten their wallets during economic headwinds.

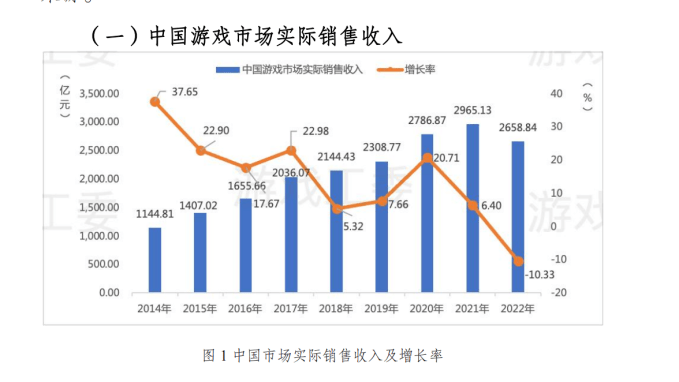

China’s video games sector posted a decline in sales for the first time since at least 2008, according to past reports from the country’s top gaming industry association. The market grossed 265.9 billion yuan ($39 billion) from video gaming sales in 2022, a 10.33% drop year-over-year, according to a new report released by the association on Tuesday. The overall user size shrank to 664 million, 0.33% fewer than the year before.

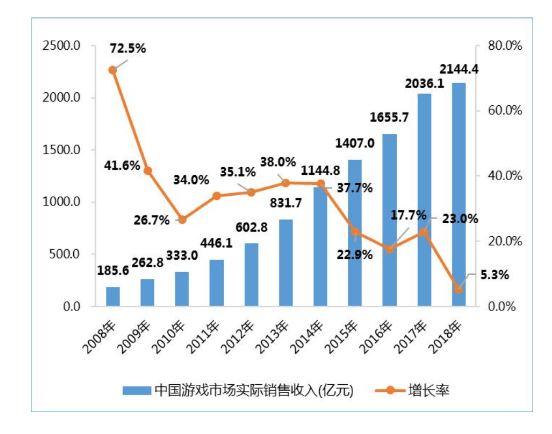

China’s game sales from 2008-2018, published by the country’s top games industry association.

China’s game sales from 20014-2022, published by the country’s top games industry association.

The declines aggravated pressure on an industry that was already struggling. In recent years, China has launched a slew of crackdowns on video games, clamping down on content that is ideologically objectional and limiting playtime among underage users. Amid the industry shakeup, regulators stopped issuing new game permits for months; the process has resumed but now takes longer and costs companies more to be compliant.

To carve out new growth opportunities, developers from scrappy studios to behemoths like Tencent are going abroad. Chinese games have been exported for years, but in recent times, they started to make a dent in the West. Toward the end of 2020, China-made titles accounted for as much as 20% of mobile gaming revenues in the U.S., according to market research firm Sensor Tower. Last July, 39 of the top 100 mobile games by revenue worldwide were from Chinese firms.

The ratio might even be higher in reality as Chinese game developers, like other types of internet services, are increasingly trying to obscure their origins to avoid the backlash of being labeled “Chinese”. India, for instance, has banned hundreds of Chinese apps in recent years, including the global hit PUBG Mobile, as its relations with China soured.

Made-in-China games recorded another rosy year in 2022 regardless, racking up $17.3 billion in overseas sales, according to the industry report. Though the figure slid 3.7% YoY, the decline was much less substantial than that of domestic sales.

China has a reputation for making lucrative, addictive mobile games, but its games giants are now ambitious about developing high-budget, global hits that will stand the test of time. Tencent, the world’s biggest games company by revenue, has a AAA console game in the works at its Lightspeed outpost in Los Angeles (Lightspeed is most famous for devising the mobile version of PUBG). Tencent’s nemesis NetEase is also busy setting up shop overseas. Having announced its first U.S. office in Austen last May, the firm recently teased another new studio.