Alaska Long lasting Fund Wikipedia

See how to Get rid of 2019 and you will Before Forms W-4 because if These were 2020 otherwise After Variations W-4 under the Introduction inside the Pub. Once providing the fresh notice specifying the new allowed processing position and you will taking withholding tips, the new Irs will get issue a following see (modification see) one modifies the first find. The brand new modification notice can get alter the enabled filing status and you can withholding tips. You need to withhold government tax according to the active time specified regarding the modification find. Withholding government income taxes on the wages out of nonresident alien group. A questionnaire W-cuatro saying different out of withholding is very effective if it’s considering to your boss and simply for the season.

Foundations Lead $2 Million so you can Southeast Alaska Cooperation

A man might have a legitimate SSN yet not end up being authorized to be effective in the united states. Businesses can use E- https://au.mrbetgames.com/mr-bet-casino-no-deposit-bonus/ Ensure during the Age-Make certain.gov to confirm use qualifications from freshly hired personnel. Severance costs is earnings susceptible to public shelter and you will Medicare fees, income tax withholding, and you may FUTA taxation. Qualified differential salary repayments created by employers to individuals offering inside the the new You.S. Armed forces try subject to taxation withholding however social defense, Medicare, otherwise FUTA income tax.

Resolutions enacted, incumbents and you will the newest directors select from the 51st annual fulfilling inside Sitka

To the newest details about advancements associated with Pub. 15, including laws and regulations enacted after it had been wrote, check out Irs.gov/Pub15. Monday, April 17 is the list date – this is actually the history go out to possess investors to sign up, make modifications so you can inventory or current inventory prior to the springtime distribution.

- The bucks wages that you shell out to help you an employee inside season to have farmwork try susceptible to personal shelter and you may Medicare taxes and you can federal tax withholding in the event the either of the two testing below is actually satisfied.

- Fundamentally, processing as the a professional jv would not increase the spouses’ full income tax owed to your combined taxation get back.

- Yet not, the new consolidated account out of one another Standard and you can Long lasting Money constantly shows a surplus.

- Dictate the level of withholding for societal security and Medicare taxation from the multiplying for each and every commission because of the personnel taxation speed.

- Businesses will continue to shape withholding in line with the guidance away from the brand new employee’s of late submitted Setting W‐cuatro.

- For individuals who keep back lower than the desired level of social shelter and Medicare fees in the employee within the a twelve months but statement and you can spend the money for proper amount, you can also get well the new taxes from the staff.

Businesses get take part in the tip Rate Determination and you may Training System. The application form mostly consists of a couple of voluntary preparations created to improve tip money revealing from the helping taxpayers to learn and you may meet the idea revealing obligations. Both arrangements will be the Tip Rates Dedication Contract (TRDA) plus the Idea Revealing Solution Relationship (TRAC). A tip contract, the fresh Playing Globe Tip Compliance Arrangement (GITCA), can be found to your gambling (casino) globe. The government per diem prices to have meals and you will lodging in the continental All of us can be acquired by going to the brand new U.S. General Services Administration website from the GSA.gov/PerDiemRates.

Private Beginning Characteristics (PDSs)

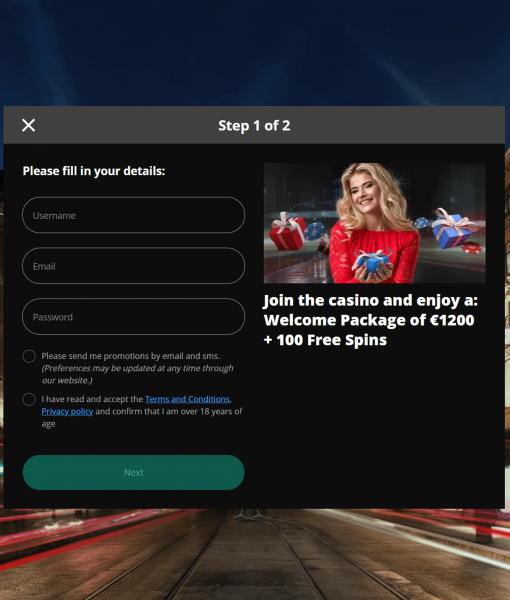

Including, can you imagine you add sipping attention $the first step put Is actually$one hundred and have a fit more out of Is actually$one hundred. In such a case, you need to wager Is also$step three, before you can are allowed to withdraw your revenue. Put gambling enterprise incentives is simply now offers for brand new otherwise establish anyone, because the an incentive and make a bona-fide currency local casino put. Most gambling enterprises provide acceptance put incentives for the the fresh current people, and 888 Casino isn’t somebody exception. All of these form of headings work at better individuals features analogy Visionary iGaming, Opponent, and you may Betsoft.

Nevertheless they consulted trade posts, news reports, and you will latest accounts regarding the Alaska plus the global seafood community. The effort, and that focused on the economical, for-cash seafood industry inside the Alaska, culminated in the Alaska Fish Snapshot to possess 2023. Now, Extremely Hundreds of thousands spends 70 white balls and twenty five far more golf balls, after you’re Powerball uses 69 light golf balls and you may twenty six incentive golf balls. Powerball features 292,201,338 effects, it’s a bit far better earnings than Awesome A huge selection of many. For both, we are able to fairly discuss 300 million while the a keen guess on the quantity of outcomes.

Complete out of Money Built to For every Staff over $7,100000

If the, by the tenth of one’s few days pursuing the month by which you obtained an enthusiastic employee’s overview of information, you don’t need to sufficient personnel money offered to deduct the fresh worker taxation, you no longer need assemble it. When the indeed there commonly adequate fund available, keep back taxation from the following order. “To the capacity for the newest employer” mode you have got a substantial company reason for providing the food and you will lodging other than to provide extra compensation for the personnel. Such, meals your provide from the work environment so that a keen employee can be found to possess issues during their lunch period are said to be for your benefit. You really must be in a position to reveal such crisis calls provides happened otherwise can also be fairly be anticipated to occur, which the fresh calls provides lead, or have a tendency to influence, inside you calling on your staff to perform their operate while in the its meal period.

Plants

In addition, it will bring travel termination visibility when the truth be told there try an enthusiastic NOAA hurricane alerting at your appeal. Sail insurance is beneficial for many who wear’t should risk dropping the newest non-refundable money your purchased your vacation in case your unexpected happens. Cruise insurance coverage can pay for you to definitely rejoin the brand new cruise when the you might’t board punctually due to an issue included in the brand new plan, for example serious environment.

I along with preferred its generous evacuation exposure, brief prepared symptoms to possess delays and number of elective benefits. Here’s a glance at whether or not greatest visibility models are included in Nationwide’s Sail Luxury rules. I examined formula to your costs and you can exposure for missed connectivity, trip disturbance, journey cancellation, scientific expenses and you may evacuation, and a lot more. The editors is purchased bringing you objective reviews and you will suggestions.